Content

This article covers the understanding, and components of buy side and sell side liquidity. Along with that, we will look its predictive nature in technical analysis. When prices reach these buy side and sell side liquidity levels, a large number of orders are executed, leading to an imbalance in the market’s supply and demand. This results in a sudden surge or decline in price, depending on what is sell side liquidity the direction of the breakout. The Inner Circle Trader (ICT) methodology offers a distinctive perspective on the markets, attracting numerous traders with its unconventional approach to price action in foreign exchange, crypto, and other markets.

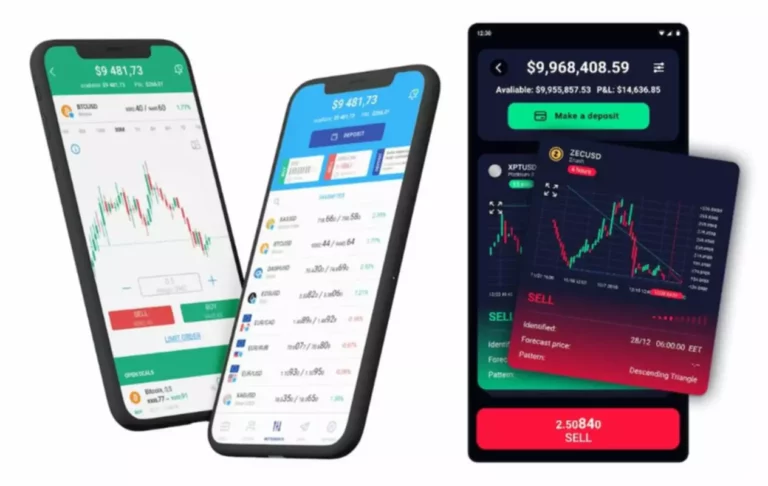

Buy Side Liquidity And Sell Side Liquidity in ICT Trading — How Does It Work?

Institutional trading impacts market mechanics through the introduction of large volume trades and strategic placement of resting orders. Institutions often accumulate orders at critical price points, thereby manipulating the currency’s supply and demand and driving market prices. Their activity can lead to price slippage and impact the overall flow of the Forex markets, both on the buy and sell side. Market liquidity is the cornerstone of the Forex market, https://www.xcritical.com/ reflecting the facility with which traders can purchase or sell positions without causing a significant impact on price stability.

How to Identify Liquidity Levels in Trading

Buy-side liquidity represents a level on the chart where short sellers will have their stops positioned. It represents a level on the chart where long-biased traders will place their stops. In both cases, these levels are often found at or near extremes as the tops and bottoms of ranges are often viewed as areas where traders are ‘proven wrong’ and, therefore, will want to get out of their trades. At the heart of market mechanics, structural liquidity refers to layers of buy and sell stop losses situated at crucial market junctures—trend breaks or structural levels.

How to Identify a Liquidity Sweep

Institutions and Market makers need large volumes of liquidity to execute their big trades. By triggering buy or sell stop orders from retail traders, they convert pending orders into market orders, creating the liquidity necessary for their trades without causing significant price slippage. Because retail traders tend to place buy stops at predictable levels, these areas become liquidity pools. For large institutions, which need substantial liquidity to fill their large sell orders, these pools of stop orders are highly attractive. Buy side and sell side liquidity in crucial concept in SMC and ICT trading concept.

Canwell suggests that it’s possible that both models will converge as market makers offer both the direct relationship with tailored pricing and the agency model with more adjusted pricing. Referring to the trend, Canwell said that institutions can engage with market makers for executing small cash flow baskets (5% of average daily volume and below), as well as some larger trades (5%-20% of ADV). As a global market maker, Optiver manages risk by unwinding their positions across a diverse range of equities, futures and options. This helps ELPs offer better prices to the buy side than is otherwise found on the exchanges.

These orders are placed below the significant price levels such as previous swing low or equal lows. A liquidity sweep is a market move where price briefly surpasses a key level, such as equal highs or lows, to trigger stop-loss orders or breakout trades before reversing in the opposite direction. It occurs when the market seeks liquidity from retail traders before continuing or reversing a trend.

Though the concepts might be a bit foreign to traders who are used to a more traditional technical analysis approach, there is a reason that the ICT methodology has become so popular. At their core, markets are built off of price action and trend, and important levels can play a big role in where and why the price reverses. “Smart money” players understand the nature of this concept and commonly will accumulate or distribute positions near levels where many stops reside. It is, in part, the sheer amount of stops at key levels that allow a larger player to fully realize their position. Once the level at which many stops are placed has been traded through, it’s often that the price will reverse course and head in the opposite direction, seeking liquidity at the opposite extreme. Liquidity is crucial in understanding Forex price action because it provides insights into where and how the next directional price moves may occur.

Structural liquidity in the Forex market refers to the layering of buy and sell orders around critical price points, such as historical highs and lows or areas of trend breaks. These points often serve as catalysts for significant price movements. Large financial institutions commonly manipulate this liquidity by absorbing or deploying strategic trades, impacting the overall market direction. Resting orders, such as limit orders and stop losses, contribute significantly to market liquidity by creating a buffer of potential transactions at certain price levels. Their presence ensures smoother price transitions and can often signal or trigger large market movements when these orders are activated or targeted by buy side liquidity providers.

- Through their actions, institutions can amplify Forex market dynamics, moving prices with their large-volume orders.

- “The need for asset managers and service providers to remain compliant with new and evolving regulations is more relevant than ever,” they said.

- For large institutions, which need substantial liquidity to fill their large sell orders, these pools of stop orders are highly attractive.

- PD Array refers to key price levels like Order Blocks, Fair Value Gaps, or Imbalances zone.

- The trend of trading directly with market makers began in the ETF market and single stock options desks through a request-for-quote (RFQ) mechanism.

Sell-side liquidity refers to the ability of sellers to sell large amounts of contracts without significantly affecting the price. This type of liquidity is important for large institutional investors, such as hedge funds and investment banks, who need to buy/sell large amounts of contracts without significantly affecting the price. Liquidity hunts refer to a strategic move by institutional traders to grab pending orders and sell stops. This happens by pushing the price below key support area (swing low) where these stops are placed. Because retail traders tend to place Sell stops at predictable levels, these areas become liquidity pools. For large institutions, which need substantial liquidity to fill their large buy orders, these pools of stop orders are highly attractive.

This happens by pushing the price above key resistance area (swing high) where these stops are placed. Understanding the concepts of liquidity is crucial for understanding concept of “Liquidity Sweep”. In trading market context, liquidity refers to how easily an asset can be bought or sold without significantly affecting its price. Market orders, on the other hand, involve buying or selling at the current market price.

The significant capital and strategic direction from these institutional traders can lead to trending movements and potential structure breaks in the market, indicating opportunities for other traders. Buy Side liquidity in SMC and ICT represents an important concept related to market movement. These orders are mostly Buy stops which are placed by retail traders to protect their short position. These orders are placed above the significant price levels such as previous highs or equal highs. Sell Side liquidity in SMC and ICT represents an important concept related to market movement. These orders are mostly Sell stops which are placed by retail traders to protect their long positions.

Comprehending how these market makers operate opens the door to potentially predict, with greater accuracy, the dynamic rhythms of the Forex market. Sellside Liquidity (SSL) refers to the price levels where a large amount of pending sell orders are placed. These orders are placed by long-biased traders as their stop loss in order to close out their long positions. These sell stops are typically positioned below key levels, such as the lows of the previous day, week, and month. Understanding these levels are crucial, as they indicate points where significant amounts of sell orders may trigger, leading to a potential market reversal. Individual traders can identify and trade with big players by analyzing market liquidity, price action, and volume data.

In April, The Trade reported that more than 25 percent of buy-side firms are currently sending over 10% of their flow directly to market makers. This is based on a recent survey of 225 buy-side head traders conducted in late 2023 by Optiver in partnership with The Trade. Under MiFID II’s systematic internalizer regime, market makers formed SIs and morphed into electronic liquidity providers.

With highly volatile markets becoming the norm, it is important that buy-side firms have a solid and robust liquidity risk management program in place, according to Confluence. They strategically leverage the collected buy orders at these highs to drive prices upward. They create good conditions for buying and selling assets, making the most of price changes to get more money. Traders can look for setups supporting the ongoing trend when the price exceeds important liquidity levels. Buy-side firms that are left with the challenge of wielding large chunks of capital in an increasingly crowded marketplace for traders are even left out of trading some markets, due to their liquidity constraints. In the past, investment managers may have been concerned about interacting directly with market makers’ proprietary risk books.

My passion for the financial world drives me to produce content that is both insightful and valuable for those interested in understanding market trends and financial strategies. In the context of technical analysis, liquidity is the concern of sharp traders. Institutions requires large amount of liquidity to enter and exit positions. SMC and ICT trader look for the footprints of smart money in the market.